Commenting on FY2019 financial results

Following the approval of draft individual and consolidated financial statements as of 31 December 2019, on Monday March 30th 2020 our top management hosted a public Investors Webinar – as customary – to discuss results, answer questions and address doubts. What follows is the recording and the transcription of the webinar, hosted by Ms Micaela Cristina Capelli – Executive Director and Investor Relator, Mr Matteo Monfredini – Chairperson, CFO and Co-founder, and Mr Nazzareno Gorni, CEO and Co-founder (their profiles can be found here).

You can watch the webinar recording at this link. If you have any further questions or would like to get in touch, please feel free to email investors.relations@mailupgroup.com at any time.

Micaela Cristina Capelli (MCC)

Good afternoon everybody, and good morning to our investors connecting from the other side of the Atlantic. This is the investor conference for the presentation of MailUp Group’s 2019 full year results. I will be hosting the conference alongside Mr Gorni, CEO and founder of the company, and Mr Monfredini, Chairperson, CFO and one of the founders of the company as well. The conference will comprise a presentation of the main full year 2019 figures as well as a comments and questions section.

Matteo Monfredini (MM)

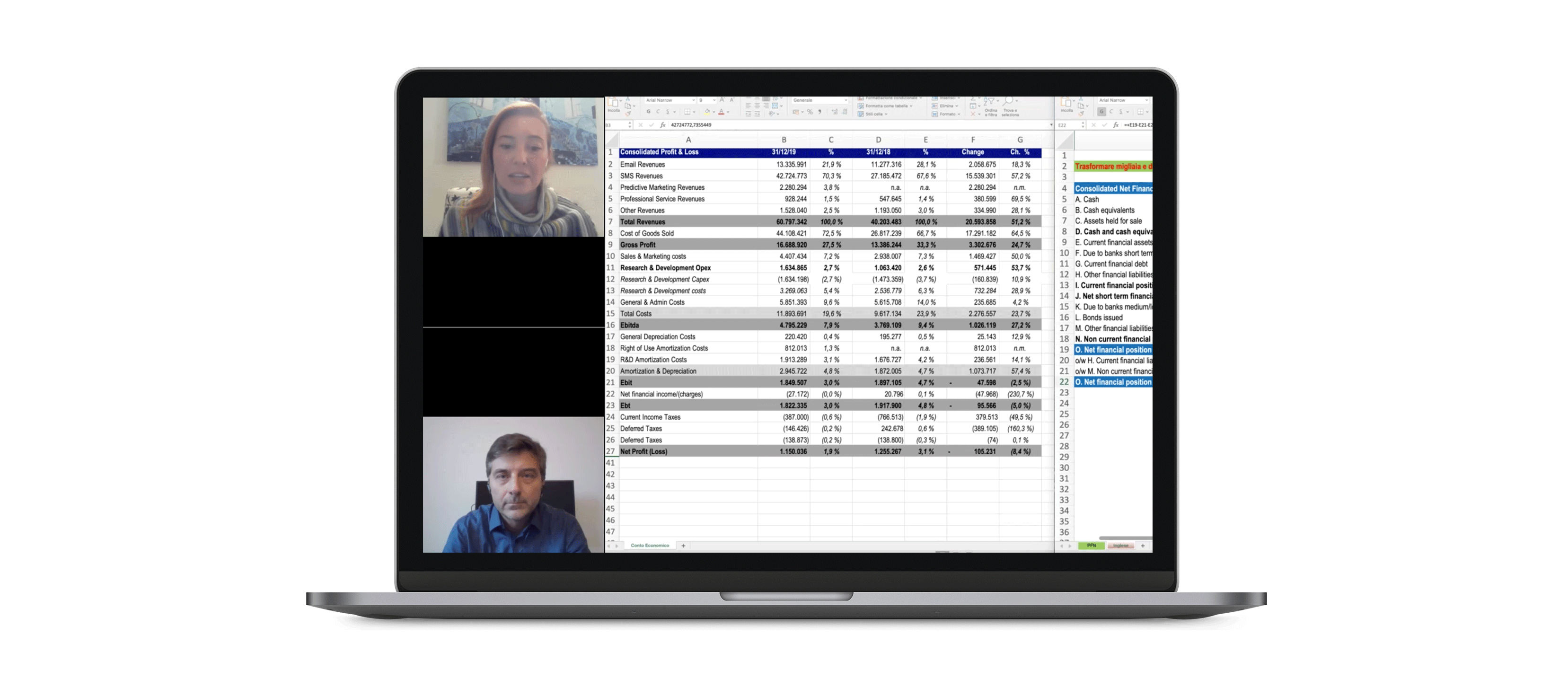

Let’s see what’s happened during 2019. The full-year consolidated P&L posts total revenues in excess of €60.8M, showing an increase of €20M that means an increase of 51% versus FY2018. In terms of organic growth the increase was +46%. 2019 is in fact the first year we started the consolidation of Datatrics B.V., the company we acquired at the end of 2018.

As per the results by business line, the SMS line posted the biggest top-line growth in excess of €15.5M (+57%) versus FY2018 at over €42.7M consolidated revenues, particularly because of Agile Telecom’s volume growth. In detail, €14.8M of €15.5M of SMS line growth are related to Agile Telecom.

The Email line showed an increase of 18%, with revenues in excess of €13.3M, thanks to the excellent performance of BEE editor, which posted a substantial increasing growth to €2.6M FY2019 revenues, which means 111% more vs €1.2M in FY2018.

A positive trend was also registered for Professional Services which increased by 69%.

The Predictive Marketing line also registered excellent results, amounting to €2.3M revenues, thanks to the performance of the newly acquired Datatrics B.V. and the newly incorporated domestic subsidiary Datatrics S.r.l., for which no comparative data are available for FY2018 as they are first consolidated at P&L level in 2019.

However, Datatrics B.V.’s unaudited individual report for FY2018 registered revenues of about €1M. This means a revenue increase of 132% vs. FY2018.

Foreign consolidated revenues amounted to €28.8M, showing a substantial growth trend on FY2018 both in absolute (with an increase of 79%) and relative terms (with 47% incidence versus 46%).

Cost of goods solds has increased by about €17,3 M with a big part of SMS traffic direct cost. Operating costs have increased mainly due to Datatrics consolidation costs, in particular for marketing costs.

Consolidated EBITDA amounted to €4.8M, growing by +27% versus FY2018, with an 8% incidence on revenues. The positive net variation exceeding €1M is mainly due to two different factors. On one side, the positive impact of €834,196 from first-time adoption of the new IFRS 16 on lease accounting without comparative data restatement, starting from January 1, 2019. On the other side two negative variations: (i) the negative impact of about €1M from contingent liabilities on certain supplies for Agile Telecom; and (ii) the negative effect of Datatrics start-up margins that was widely expected in our investment plan agreed in the acquisition process.

As per sub (i), this incident was completely resolved both from a legal perspective, with a transaction, and technically, by swiftly activating alternative routes, avoiding negative prospective impacts on margins.

If on one side the EBITDA margin benefits from first-time adoption of IFRS 16, on the other side Earnings Before Taxes incorporate all costs moved under EBITDA.

So, Earnings Before Taxes amount to €1.8M, decreasing by 5% on FY2018, with €2.9M depreciations (increasing 57% versus FY2018), related to IFRS 16 first-time adoption which caused €821,013 greater amortisations and about €39,000 greater financial expenditures.

Consolidated Net Earnings for FY2019, after estimated current and deferred taxes, amount to €1.2M, decreasing by 8% versus FY2018.

Taking a closer look at business units numbers, it is clear that in 2019 we aimed at revenue growth rather than marginality. Our two startups, BEE and Datatrics, doubled their revenues, and our intention is to strengthen investments also for 2020. MailUp and Agile Telecom, with their consolidated businesses, are financing our investments.

Starting from FY2019, selected recognition criteria have been introduced for holding service costs allocation to business units, affecting business units EBITDA other than MailUp. The reason is mainly the increased dimensions of the Group and the centralisation of certain internal activities at holding level.

So, the “EBITDA FY2019 Restated” column shows business units EBITDA restated with 2018 holding costs allocation criteria. These data, and relative changes, are unaudited and presented for comparison purposes only.

The consolidated Net Financial Position as of 31 December 2019 is negative (for net cash) and amounts to €2.4M, decreasing versus the previously recorded amounts of €6.4M as of 31 December 2018.

This variation is highly impacted by the bigger debt figure from IFRS 16 first-time adoption, for an amount of €4,6M. If we look at the numbers without the effect of IFRS 16 accounting principle changes, the net financial position has increased cash for about €635k.

This results include about €1,25 of more cash minus €620k of more financial debt.

Another important impact on net financial position is due to the cashouts for the last earnout on Agile Telecom (€600k) and two more tranches on Datatrics’s purchase price for €748k.

Nazzareno Gorni (NG)

We are very satisfied with FY2019 results. Everything went as expected for all business units. Our two main business units – MailUp and Agile Telecom – are very profitable and they are financing our two startups, Datatrics and beefree.io in the US. Organic growth is important – 46% – roughly the same as the previous year.

All of this is also based on sound cash generation – because despite the two earnouts we paid (€1,3m), we are cash positive with a conversion rate (OpFCF/EBITDA) still pretty high, around 75%. This is good news also considering the breakdown periods related to Covid-19.

Investor question

Are you changing your internal cost budgeting and investment plans significantly for 2020, based on the new environment?

NG

We are preparing some corrections to our plans in order to be prepared for any possible impact that may come this year, but at the moment we don’t have specific figures that allow us to make any predictions. We are seeing a slowdown from some business units, in particular from MailUp and Datatrics: in their marketing funnel, less leads are coming in as opposed to the previous weeks. I think this is quite normal, but it’s not reflecting on revenue or sales figures yet.

We’ll need a few more weeks in order to have exact numbers, also considering that other business units – such as Acumbamail and BEE – are not at the moment experiencing any slowdowns. The investments that we originally planned and all our projects are still on track. The only measure we are considering is delaying some of the hirings over the next few months. Also, many marketing events are being canceled, therefore we’ll be able to save some money from them and direct it to other activities.

Investor question

What is the approximate market mix of revenues for the Group by sector?

NG

Apart from Agile Telecom, which works with very specific clients – wholesale SMS senders -, other business units are active across all industries, including institutional enterprises, manufacturers, non-profits, retailers, and so on – making for an extremely diverse source of revenue. The business unit that could be most affected by Covid-19 is Datatrics, as it works with many clients in the travel and hospitality industries – for sure the ones that could suffer the most from this situation, and that currently account for approximately 20% of the overall Datatrics sales.

On the other hand, we may be expecting a higher churn rate from clients canceling their subscriptions. And yet, I’m not sure this will even happen: as soon as the Covid-19 emergency ends, marketing tools to communicate with clients will be the first to be used. My view is that businesses will be willing to cut their advertising budgets, and yet to retain the tools they use to communicate with customers. Also, the average price of our solutions is around €7-8k per year for Datatrics, €1.5k for MailUp – not that impactful on most company budgets.

MCC

Adding on this, we’re seeing mixed effects from a combination of factors and often interesting trends that we’ll try to mix and put forward as the year unfolds. On April 10th we will release a sales preview for the first quarter of 2020 and then mid-May we’ll release a full quarterly report. By then we should have a fuller understanding of what’s potentially happening.

Investor question

Do you think there are exceptional assets coming available? How big a focus is M&A for you?

NG

We are active on the M&A side, although of course this period makes it pretty difficult to continue a conversation. But we do have a couple of conversations going. We are looking at companies that are not startups, so they can contribute both in terms of sales and margins to our overall results.

We’d prefer to acquire a company with at least some international revenues. Perhaps a US company, even though in that market multiples are much, much higher than in Europe, and this makes a potential acquisition all the more difficult for us.

Investor question

What institutional meetings do you have in your calendar for the coming days?

MCC

As you might know, we had to cancel all our physical conferences, starting from the one that was planned for mid-March in California. We were able to shift to a complete virtual meeting mode, so we still keep our conference plan going – starting from tomorrow, we will take part in the Virgilio conference, which was originally meant to take place in London and will now take place totally virtually.

We have over 20 meetings scheduled so far. After that, we planned to be in Paris for the CF&B Videoconférence, which too will be kept in full virtual mode. Then, the AIM/STAR Conference from Borsa Italiana will be in place, although in a virtual mode. The agenda is very busy, a sign that the company and the stock are found very interesting by investors. We’re working on every possible opportunity that would allow us to increase the awareness on the stock and on the share price.

Investor question

Are you considering any potential uplistings or foreign markets?

MCC

We are considering that very carefully. Of course, we do have legal obligations and legal requirements that are currently met by the company. On the other hand, we are checking substantial requirements, among which might be the size of the company.

So our plan is to achieve a substantial size in terms of market capitalization in order for the company to be attractive for a big enough number of investors in order to allow us to hit up a more sophisticated market, be it the STAR segment of the Borsa Italiana or potentially a foreign market.

This is also true for certain of our subsidiaries that might be attractive targets for foreign listings. So we’re still very hot on the topic, but still checking whether or when it will be a good trade-off between the expenses we’d incur to get access to more sophisticated markets, and the market cap we’d need in order to get the appropriate attention from investors.

NG

Regarding the capital increase information that we released during the last Board of Directors about the option of a capital increase up to €30 million in the next few years – this is not going to happen.

The company is very healthy thanks to its €9 million in cash safely deposited in the bank, so we are not looking for a capital increase right now.

MCC

The overall context of the proposal for the general shareholder meetings was for a combination of both a capital increase and convertible bonds, but that was just to elongate the effects of a resolution that’s already in place and that clearly was not abused by the company. So this is totally prosecuting the status quo.

We’ve been carefully selecting investors that we’re meeting and we’re very happy of our investor base and we care about every one of you and we’ll still be very careful about the type of deals we will propose to the shareholder meetings for your approval and for the pricing. The reason why not many deals might be happening in the future might be related to the pricing. We need to get to a size and price that we feel confident about for bringing along further capital markets deals.

Let me remind you that later in the year it is our plan to disclose an ESG report. We have worked on our investor base and sustainability, and we care about people working inside and outside our organization. We will be providing extra information on the activities we put forward on the ESG side with a dedicated document.

Investor question

MailUp Group has experienced a phenomenal growth and development. How can you keep this momentum going in 2020? How can you use this difficult environment to keep taking the Group to a higher level?

NG

On the business side, what we see is that the online channels and digital activities have increased in the past few weeks. Companies are heavily resorting to email and SMS to communicate with their clients and with citizens. This translates into an increase in traffic and in spiking email-related key performance indicators – click-through rates and open rates. From this angle, we are not facing any challenges apart from those arising from potentially affected industries. We will continue to provide our services. On the M&A side, some opportunity windows could open up and we are ready to catch them.

The same applies to the SMS side, affected by a widely foreseen decrease in volumes related to large retailers and yet experiencing an increase in transactional SMS text messages. By staying at home, people are incrementing online purchases and gaming – activities that require some sort of authentication or one-time password. This provides an interesting increase in a type of traffic that usually offers good marginality.

MCC

I’d like to wrap up with a general consideration, which is very close to all the very detailed information that was just shared. On one hand, while so many sectors on a macro level might be trending towards an economic downturn, yet digital tools will be paramount for the recovery once we get out of this crisis.

And on the other hand, this crisis has possibly allowed people at various levels to become more and more educated about digital tools and to switch to a digital form of exploiting services. We still don’t know the mix of these combined effects, but that might provide a compensation that still keeps our growth rates up and going.

You can find the full press release of FY2019 results at this page.